How ProService Finteco supports PEPP deployment

With many years of experience in the field of investment products, the implementation of PEPP is, for us, a natural stage of their further development. That is why we keep abreast with the latest trends and directions of any legal arrangements as early as the first stage of clarification of final regulations on PEPP, to adapt the technological infrastructure offered to our clients accordingly.

Our services are implemented as part of the Managed Services offer, which provides full support in four areas of activity:

Ongoing regulatory monitoring under PEPP

The PEPP regulations are still in the final stages of development. In ProService Finteco, we continuously follow trends and provide information about introduced changes. Using our services, you are sure to have up-to-date information, which allows you to take optimal actions and implement effective solutions quickly.

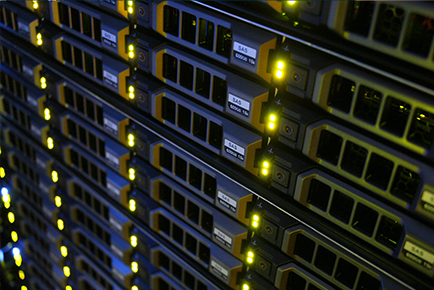

We provide full infrastructure and business applications

Keeping our finger on the pulse of PEPP regulations’ development, we continuously design the necessary technical and process infrastructure needed to handle PEPP-related processes efficiently. Many years of experience in managing investment funds, including pension programs like IKE, IKZE, PPE, PPK, allows us to quickly adapt our existing technological infrastructure and B2B and B2C business applications to new regulatory requirements.

Support for back-office processes

The emergence of new investment solutions like PEPP will result in the appropriate adaption of business, accounting, clearing and reporting processes in ProService Finteco. It will be crucial as well to focus on requirements as part of the process automation, concentrating on their efficiency both on the back-office side and as part of increasing the quality and customer service satisfaction.

Multi-channel customer communication – front-office

2021 will be the year of further process automation and end-user self-service. Our solutions, such as video verification, online shopping automation and mobile solutions, will be incorporated into PEPP’s customer service strategy. We will also provide full support within the scope of customer service using the Contact Centre.